To provide my top picks for 2026 on a somewhat timely basis I am combining my recap of the 2025 predictions with the new ones for 2026. Those who follow my blog for some time should not be surprised that I am picking 6 of the 7 stocks that I chose last year so the only change to my top picks will be replacing The Trade Desk with AMD. Just to remind you: I believe that the greatest wealth creation occurs through investing in well run companies that have a long-term sustainable advantage and then holding their stock for a number of years. Tesla has been a great example of this as my 2013 purchase price (adjusted for splits) is $3.06. So, as of 12/31/2025 it is up about 147X! Of course, holding the stock should not be automatic as it’s important to reconfirm that the advantage persists.

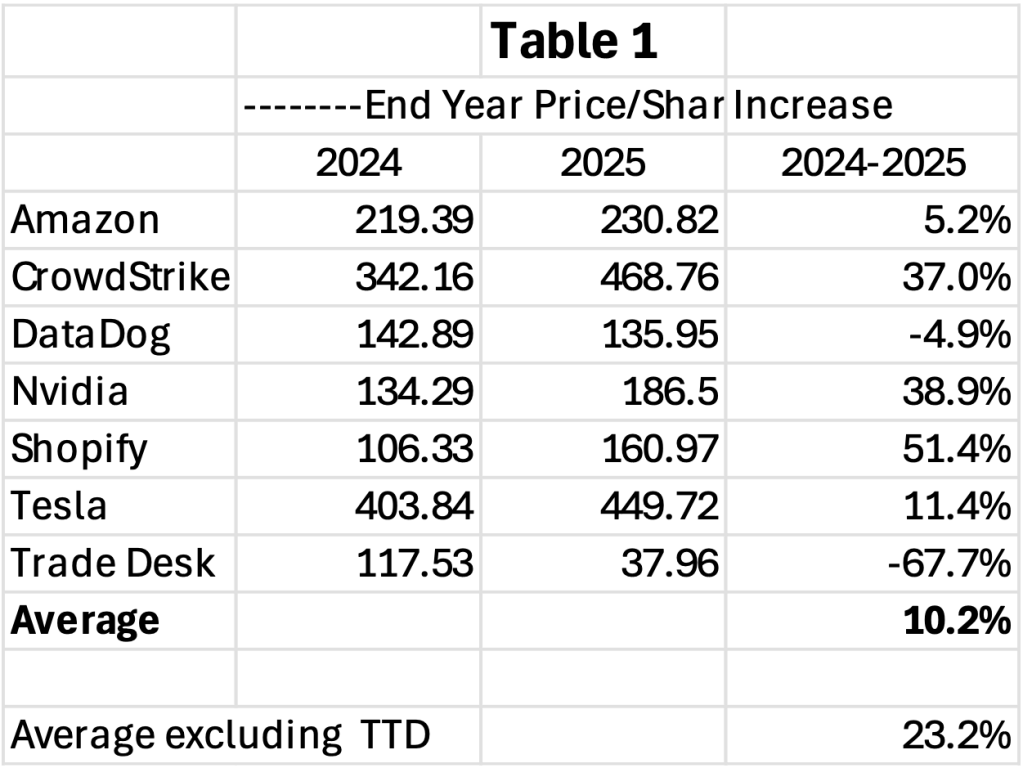

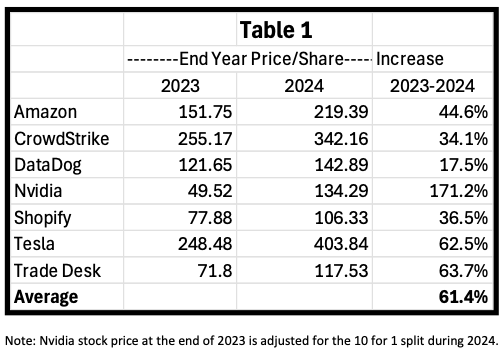

Performance of the 7 Stock picks in 2025

As can be seen in Table 1, our picks for last year performed below the market due to the precipitous fall of The Trade Desk (TTD). If we exclude TTD, our other 6 picks taken as a group beat the market by posting a 23.2% average increase in their share price. CrowdStrike, Nvidia and Shopify each had very strong gains of between 37% and 51%.

Amazon and Tesla were up, 5.2% and 11.4%, respectively, after extraordinary share appreciation in 2024 (Tesla was +62.5% and Amazon +44.6% in 2024). DataDog was the other stock that did not appreciate in the year despite very strong revenue growth.

Accuracy of our 3 Non-Stock forecasts in 2025

All three of our non-stock predictions proved valid but one of them just marginally.

First 2025 Prediction: The Housing market will experience increased unit sales in 2025

Affordability was at a 30-year low at the start of 2025 but improved over the course of the year as price increases slowed and mortgage rates eased slightly from their recent peaks. Construction of new homes coupled with more existing homes coming on the market meant that by the end of 2025 inventory of homes for sale reached the highest level since pre-pandemic days. This resulted in an increase in home sales but only a small one.

Second 2025 prediction: Trump tariffs will not be as high as expected

This prediction proved quite true as it became evident that President Trump’s initial push was intentionally set above where he expected to wind up. So, for those countries where an agreement has been reached and those close to one the actual tariffs are much lower than many feared when Trump began the process. And although inflation has not settled down to 2.0%, the fear that tariffs would cause it to accelerate has yet to be proven accurate. Still, many feel that the tariffs will cause a bump in inflation during 2026.

Third 2025 prediction: Relocation from high tax states like California and New York to low or no tax states like Florida and Texas will continue.

According to Fox news, 255,000 more residents left California in 2025 than moved in. New York experienced about half that net loss. The California losses were up over 60% compared to the 2023-2024 period. The biggest gainers from this migration were Texas and Florida, both of which now have an acceleration in the Tech sector, partly because of this migration. My personal experience is that many of those leaving are high taxpayers and this could accelerate if the state continues to levy more taxes on them. The estimates are that the top 10% pay 80% – 85% of all taxes and the top 1% pay an astounding 40-50% of California income taxes. Suffice it to say that while many of the highest taxpayers are leaving the state it seems unlikely that many high income people would choose to move here. This means the net loss of taxes is likely much greater than the corresponding loss of population.

My 2026 predictions

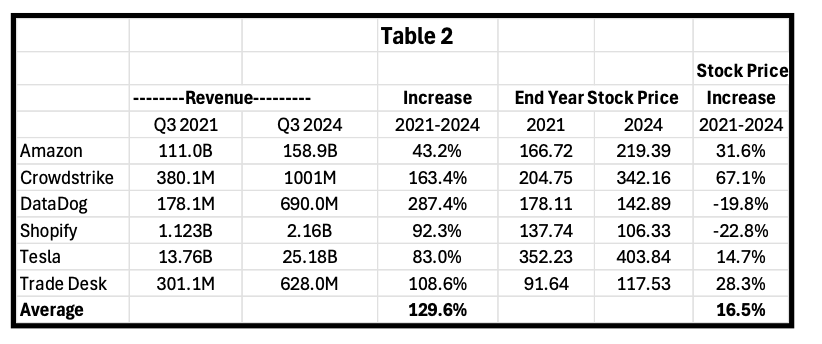

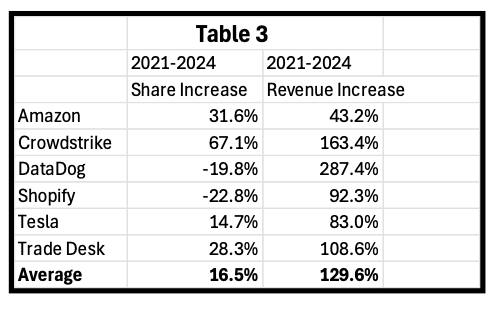

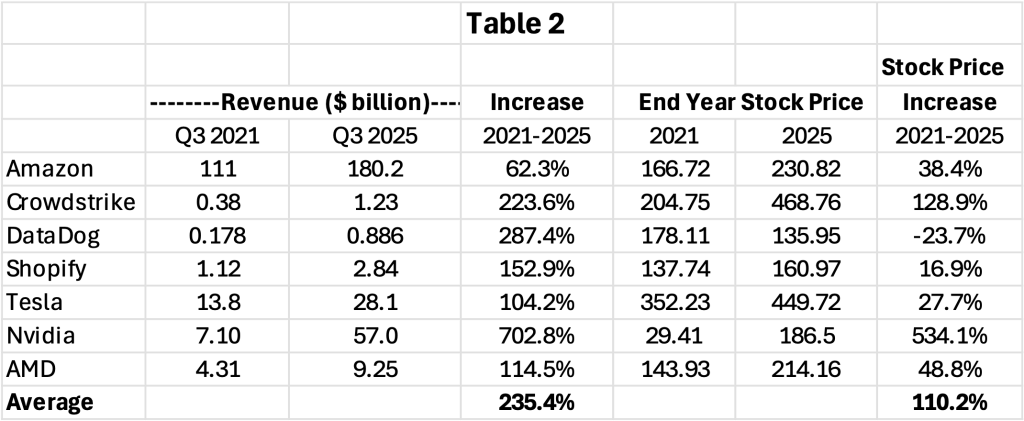

As stated above we are continuing to recommend 6 of the 7 stocks as our picks for 2026. You may wonder why I am continuing to recommend them after their stellar performance over the past 4 years as their average stock increase was about 2.8 times that of the S&P 500. We’ll discuss each company individually but first I want to provide 2 tables that add some perspective.

Note: For Nvidia and CrowdStrike results are for Fiscal 2026

As can be seen in Table 2, while the 7 had an average stock price gain of over 110% (versus 40% for the S&P) since 2021 mostly driven by Nvidia and CRWD, their average revenue gain during the same period was nearly double that. Additionally, Nvidia, Amazon and Shopify earnings grew far in excess of revenue at 1,240%, 13,829% and 3,300%, respectively. While it is likely that tech stocks were somewhat over-valued at the end of 2021, I believe these numbers indicate that this is not the case today for the 7 stocks we are highlighting.

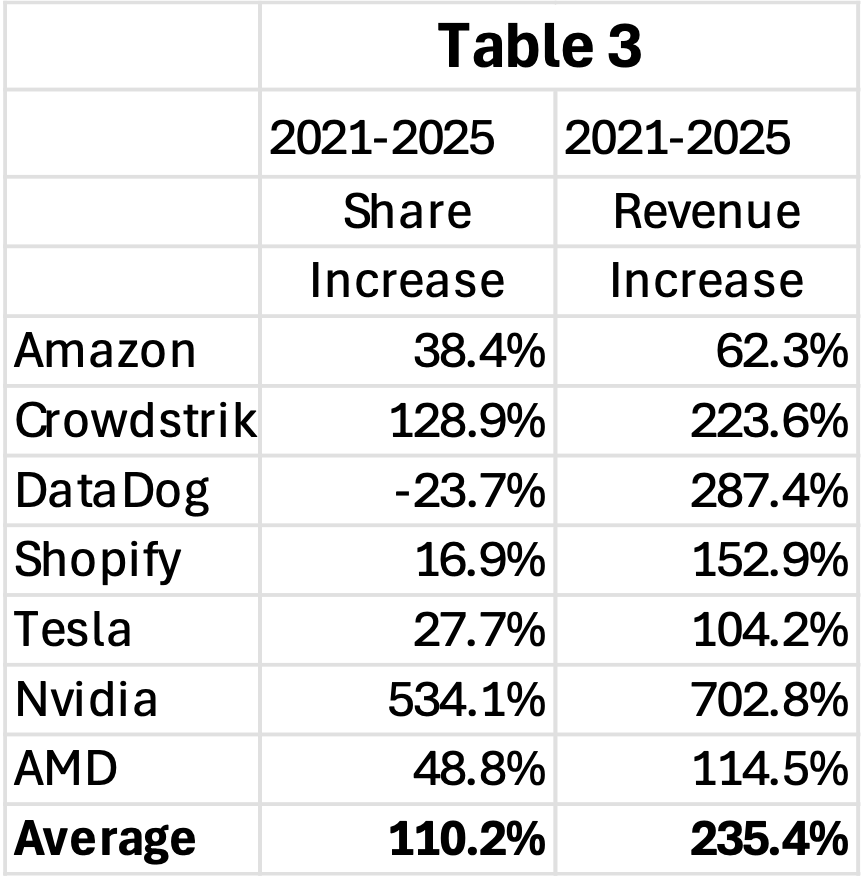

In Table 3, I’ve consolidated the comparison of share increase vs revenue increase. None have experienced stock appreciation close to how much their revenue has grown and only 3 had share appreciation above the S&P. In fact, Data Dog and Shopify revenue are up 287% and 153%, respectively, in the 4-year period and DDog’s stock is down and Shop’s is only up 17%! For DDog the fact that its earnings did not grow in the period can be the cause but in Shopify’s case, earnings grew far faster than revenue and revenue growth is understated as the 2021 number includes Shopify Logistics which was sold to Flexport in 2023. I do not expect the companies to return to the P/R ratios they experienced in 2021 but do believe the current ratios still leave room for improvement. And I expect all of them other than Amazon to continue to grow revenue over 20% annually going forward. With that, we’ll now move on to the top 10 for 2026. (Note: all beginning share prices are the stock price at the end of 2025 as 6 of the 7 are continuing recommendations.)

2026 Stock Recommendations (Note: base prices are as of December 31, 2025)

- Tesla will continue to outperform the market (it closed 2025 at $449.72/share)

Tesla is the most complex and most controversial of our recommendations, so we’ll go into some detail in this post regarding the pros and cons that surround it. While Tesla did appreciate over 11% in 2025, its stock is in a yoyo pattern as auto sales have atrophied but future opportunities in Robotics, Energy, Self-Drive and a Taxi Service are massive. Still fears over the tepid auto growth has led to Tesla stock only being up 28% in the 4-year period from 2021 to 2025 despite revenue growth of over 100%. Because of the bifurcated nature of Tesla forecasts (tepid auto revenue growth coupled with potential massive but highly unpredictable growth in other areas), Tesla options trade at large premiums. So, this recommendation includes buying the stock and selling options with a 620-strike price that expire on January 15, 2027 (one year out). The net cost of the Tesla stock after subtracting the $51.40 premium on the options is about $398 (as I write this). Should the options be exercised, the return would be 56%.

Tesla has numerous issues and opportunities that cause the stock to be quite volatile:

- BYD and other Chinese auto companies have very competitive products at lower prices than Tesla and this has resulted in Tesla sales slumping in Europe and China. Since the Chinese companies are supported by the government they will continue to have a cost advantage.

- Cybertruck sales fell well short of expectations with about 20,000 – 25,000 units sold in 2025 down from 2024 and significantly below earlier expectations, including mine. I still believe it is an appealing product with little direct competition but the high cost coupled with numerous recalls has undermined demand. Remember the initial backlog for the product exceeded one million units. If Tesla can substantially lower the manufacturing cost and eliminate product defects it may still become an important growth driver. Since this has yet to happen forecasts do not reflect any Cybertruck sales improvement so it remains a potential upside if Tesla can overcome its difficulties with cost and product quality.

- The growth in sales of BEVs (Battery Electric Vehicles which do not include Hybrids) is slowing. We always expect high growth rates to decline over time but still believe unit sales of BEVs can grow by over 20% per year for some time. However, this may be dependent on Tesla launching its low-cost model.

- On the positive side Tesla appears to be getting closer to several important growth drivers:

- Its Semi, which could provide notable incremental revenue appears likely to launch sometime in H2 of this year.The Tesla Taxi Service is in beta in several locations and is expected to begin adding to revenue by H2.Elon has stated that the first commercial Optimus robots will begin shipping in some volume by mid-year. Prototypes are already performing numerous tasks in manufacturing, the Tesla Diner and other arenas. But the product is quite complex and timing of volume production remains elusive.Sale of the Tesla self-driving module could gain momentum this year as it is already in volume use and Tesla claims it is more reliable than a human driver. But Tesla needs to get the general public on board. Once it does, this becomes a very high margin software sale. The taxi service can certainly help overcome many people’s reluctance to use self-driving.

- The energy/storage part of Tesla’s business grew 44% in Q3, 2025. This, along with services and revenue from charging stations, are growth enhancers for Tesla.

It’s important to understand that Tesla stock is being driven by its leadership position in AI. It could be the first to perfect autonomous self-driving. Doing so would enable it to be the leader in self-driving taxis (with much higher margins than autos) and to license the technology to others. Further, perfecting AI for robotics would open a new market for the company that could be a larger one than autos.

2. Shopify will outperform the market (it closed at $160.97 per share)

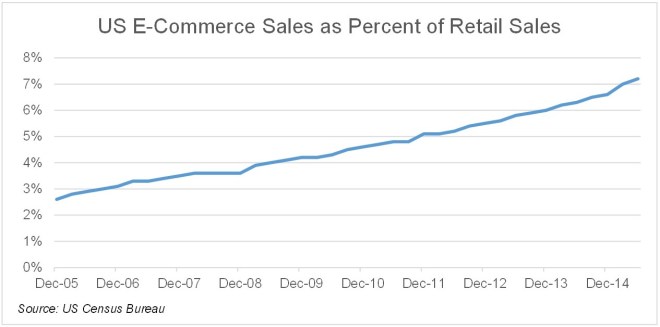

Shopify is a leading global commerce company that provides essential internet infrastructure for commerce, offering trusted tools to start, scale, market, and run a retail business of any size. Shopify offers a platform and services that are engineered for speed, customization, reliability, and security, while delivering a pleasing shopping experience for consumers online, in store, and everywhere in between. Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as Estee Lauder, BarkBox, BevMo, ButcherBox, Carrier, JB Hi-Fi, Meta, SKIMS, Supreme, Vuori, and millions more. Its platform is second to Amazon in online market share.

Shopify delivered strong results in 2025 with both GMV and revenue growth rates accelerating in North America, Europe, and Asia Pacific. The 2024 revenue growth rate of 27.67% accelerated each sequential quarter in 2025 reaching 31.54% in Q3 (with GMV growth slightly higher).

Analyst estimates for Q4 of 2025 bring the year’s total revenue increase to over 29%. And 2026 revenue growth is expected to be in the mid-20% range. This is helped by net revenue retention for the company of over 100% due to Shopify successfully expanding the services it provides to its eCommerce business customers. Additionally, because successful eCommerce companies are growing, Shopify also grows its portion of the customer revenue it shares.

We believe that tariff concerns regarding particular Shop customers are the wrong issue to be focused on as Shop operates over 5 million commerce sites so the real issue is whether total demand for goods will drop in the US and other countries. As long as this is not the case tariffs may impact which eCommerce companies benefit, and which lose share but not how much is purchased. So, while some Shop merchants may lose share others will gain as long as demand remains intact.

Our belief in the continued success of Shop is based on several factors:

- Shopify has emerged as the number one alternative to Amazon and larger companies are now being added to its customer base.

- Shop operates in 175 different geographies and has the opportunity to have share catch up in those outside the U.S. to U.S. share of commerce. This is helped by its ability to facilitate cross-border transactions.

- In recent years Shop expanded its offering to enable merchants to sell on social platforms, marketplaces, and B2B. It supports Brick & Mortar sales as well, making it a unifying platform for all types of sales.

- Shopify is in a strong position to provide its merchants with correct tariff calculations while sites not on the platform may struggle to do so.

Every six months Shop adds over 100 new features to its software, improving its products faster and more efficiently than all but the very largest of eCommerce players. Over time this has made its platform more attractive to larger merchants. Most recently Shopify is offering AI products that:

- Help Optimize product descriptions to improve search results.

- Optimize consumer search of a store for finding the right product match.

- Create professional photos of products

- Help optimize marketing campaigns.

- Lower the cost of support using Chatbots from the Shopify store.

- And much more.

Increasing the value of an AI application requires enough data for the AI to learn how to improve. Typically, the more data the better the solution can be. What this means is that those who own large pools of data have an advantage over those that are more limited. Because Shop is the solution for about 5 million online stores it has a massive pool of data to use to train its AI apps. Very few individual ecommerce sites have even a small fraction of this amount. So, in addition to benefiting from the development cost being spread over millions of Shopify customers, Shopify AI apps also are able to be trained using this data advantage.

We believe Shopify remains an undervalued stock as its price to revenue is still more than 50% lower than at the end of 2021. Shopify is also in its “sweet spot” for earnings expansion exceeding revenue growth.

3. CrowdStrike will outperform the market (it closed 2025 at $468.76 per share)

The performance of CrowdStrike (CRWD) in the past 12 months was influenced by its July 2024 outage which stemmed from a software update that had an error in it. Unknowingly, the company used it to update about 8.5 million Windows devices around the world. The update caused the devices to crash, bringing down systems from airlines to banks to retail merchants. The company undid the update and gave customers a work-around to restore their systems but some customers suffered monetary damage. While it appears that the company was not legally responsible for this damage, they did have to make some price concessions to customers which in turn impacted revenue (and revenue growth) for the subsequent 4 quarters (Q3 FY 2025 – Q2 FY 2026). CRWD’s earnings growth rate was negative for each of those quarters with Q1 of the current 2026 fiscal year at -22% and Q2 improving to -8%. In Q3, since the comparable period already included the concessions and earnings grew +26%. The stock reacted well to the clear improvements and was up 37% in 2025 finally putting it above the price it ended at in 2021!

Ironically, the outage demonstrated just how strong the Company’s position is in the market. While the outage reduced Q3 2024 earnings to about 10% lower than Q2, it appears to have had little impact on customer retention as gross retention (which measures the percentage of customers retained year/year) remained at 97% in Q3 and in Q4 down from 98% previously as CrowdStrike remains the gold standard for security. Given its revenue performance in the subsequent quarters, it appears that the long-term impact has not been material.

CRWD has now rebranded itself as the “AI Native Security Platform” given its leadership in using AI to prevent breaches. The company continues to gain share of the data security market despite the outage. Given its leadership position in the newest technology coupled with what is still just over 4% of its TAM, CRWD remains poised for continued high growth. This coupled with over 110% net revenue retention for 24 straight quarters makes CrowdStrike a likely long-term grower at over 20% per year as it recovers from outage discounts. High revenue retention is primarily driven by expanded module purchases where 67% of subscription customers now pay for 5 or more modules and over 20% for 8 or more.

4. Amazon will outperform the market (it closed 2025 at $230.82 per share)

Amazon earnings growth for 2025 is forecast at 28%. Yet the stock was only up 5.2% for the year and remains at a modest P/E ratio for a company growing earnings at this rate. Additionally, the Q4 Analyst consensus appears quite low to me as it is only 4.2% above Q4 2024 whereas Q3 earnings grew 36% and Q2 33%. Given that Amazon has exceeded the consensus forecast by an average of 24% over the past 4 quarters it seems likely to post a number well above consensus.

While the above implies a potential short-term gain for the stock we also believe it continues to trade at an appealing valuation for a company posting 30% earnings growth (when I adjust to what I believe the Q4 earnings is likely to be). I believe it trades at a modest P/E to earnings growth because revenue is only growing in the 10-15% range. Therefore, investors may believe that the boost in earnings cannot continue. However, we believe higher earnings growth is part of a long-term trend for Amazon where the high margin parts of its business are growing at much faster rates than the low margin eCommerce portion.

Amazon does have some risk if the trade war with China remains unsettled as Chinese companies account for about 30% of its revenue and a large portion of its own products are sourced from China. We believe Chinese companies will continue to sell in the US regardless of where tariffs wind up. Since Amazon has about 2 million 3rd party sellers on its platform, other companies would likely replace any drop in Chinese seller revenue as different suppliers will help fulfill demand. On the sourcing front, Amazon can replace goods that become too expensive from China with goods from other locations like Vietnam. Any increase in cost will also be felt by competitors so this should not impact Amazon’s market share. Like Shopify, the main question for Amazon is whether a tariff disruption (driving higher prices) causes any temporary drop in overall industry eCommerce revenue. However, if demand doesn’t change such a loss would be unlikely. And negotiations by the administration with China and numerous other important trading partners seem to indicate that a reasonable settlement is getting closer.

Of course, this assumes 2026 consumer spending remains as solid as it has been in 2025.

While eCommerce drives the majority of Amazon revenue, the most exciting business areas for Amazon are Amazon Web Services (AWS), advertising and media purchases. In the first half of the year AWS and advertising grew in the high teens whereas eCommerce was only up single digits. Since the operating margin for each is considerably higher than for eCommerce, earnings continue to grow much faster than the overall company growth rate. Faster growth in these two high margin parts of the company is one reason that we expect Amazon earnings growth to be higher than revenue growth in Q4 2025 and in 2026.

There are additional opportunities on the revenue side for Amazon, especially in customer purchases of media, an additional rapidly growing, highly profitable part of Amazon revenue. Most people (including myself) initially became Prime members because of free shipping. Prime remains a distinct bargain as it not only includes free shipping but also other benefits such as video streaming of movies and TV shows, some free eBooks, discounts at Whole Foods and more. If one wants Prime without ads on video the total additional cost is $17.99 per month, the same price as a Netflix subscription. Since I use Prime for video as much as I use Netflix, for me they have equal value as a streaming service. So, I view all the other benefits of Prime as being without cost since I’d be willing to pay the same price as I do for Netflix just for the video streaming.

Amazon has been increasing advertising (for those not on an ad free subscription) as well as adding charges for more content for its video streaming. The estimate of the number of subscribers to Prime as of mid-2024 was 240 million with about 180 million of those in the US. We estimate this number likely will have increased to about 260 million by the end of 2025. A $20/year increase in monetization of content per user (which equates to about one extra movie or TV series purchased every 6 months) would add over $5 billion to revenue. Such an increase equates to about $0.50 per share of earnings. I have noticed more emphasis on purchasing movies and TV shows in my own use of Amazon.

The last increase in the price of Amazon Prime was for $20/year in April of 2022, four years after the prior increase of $20 in 2018. That would imply the next increase will be in H1 2026, but it then takes about a year for renewals to work their way into the higher price. It also wouldn’t be surprising if Amazon increased the cost of a prime subscription by more than $20 as Netflix recently has done so with its standard subscription increasing by $30/year. If the increase mirrors Netflix at $30 it would add about $0.75 to earnings.

Amazon also has meaningful AI technology that could lead to lowering its own costs and generating additional revenue. And Amazon has been trimming costs (as a percentage of revenue). AI revenue has reached the low billions in run rate and is growing over 100% annually.

5. Data Dog will outperform the market (it closed 2025 at $135.96 per share)

DDog employs AI to simplify monitoring and in turn managing today’s extremely complex applications. This enables the teams that manage these systems to be considerably more efficient than would be possible otherwise and leads to lower head count as the systems grow. DDog provides anomaly detection, forecasting, outlier detection and more to intelligently manage large numbers of objects. DDog has over 100% revenue retention partly because, like Crwd, it continues to increase the number of modules an average customer subscribes to. Currently close to half its customers purchase 4 or more modules.

Like many other high growth subscription-based software companies, Datadog experienced another solid year in 2025 with revenue growth running about 28% through Q3 and forecast at over 24% in Q4. Since the company consistently exceeds Analyst forecasts, revenue growth could remain at around 28% or higher. This consistently high revenue growth rate has resulted in 287% higher revenue than 4 years ago. Yet the stock is nearly 24% lower than it was at the end of 2021, a rare occurrence for a company at that high a 4-year growth.

The likely reason that the stock has not performed lies in the fact that the company has not translated such strong revenue growth into earnings improvement. As a result, its P/E remains at about 60X earnings. This is not particularly high for a subscription software company growing revenue by over 25%, especially one with a 100% revenue retention rate. So, while we don’t expect DDog to regain the PE multiple it once experienced, we do believe the combination of high earnings growth and a modest PE expansion could make it a strong performer in 2026.

6. Nvidia will outperform the market (it closed at $186.50 per share at the end of 2025)

Nvidia is one of the strongest ways to invest in the AI evolution. Its generative AI-optimized GPUs have a technology lead on its competition and are needed by companies moving to AI. The demand for such a product currently exceeds supply, giving the company several quarters of backlog. Because of the shortage of supply coupled with a superior product Nvidia has significant pricing power.

In Q3 the company’s revenue grew by over 66% and earnings by over 60%. The Analyst consensus forecast for Q4 shows both growth rates improving, not usual for a company at these elevated numbers. This may be due to restarting shipments to China after negotiating with the Trump administration. Based on current earnings forecasts the stock is trading at about 24.5X analyst earnings forecast for fiscal 2027 (year ending in January 2027). Given that we expect the company to exceed the analyst forecast, we believe Nvidia may be trading below the S&P multiple of what turns out to be actual earnings next fiscal year. For a company expected to increase revenue and earnings by over 50% in FY 2027 this remains quite low.

Make no mistake, this will be a volatile stock given its startling growth coupled with historic risk associated with the semiconductor sector. One reason Nvidia’s multiple is lower than other entities with 20% plus growth rates is investors are concerned that chip cycles run their course and during the latter stages of each cycle demand falls and unit prices tumble. The question of whether current pricing can be maintained as stronger competition emerges is an overhang. AMD appears to be closing the technology gap with Nvidia but remains unable to produce the kind of volume that would damage Nvidia sales. Since both companies are significantly backlogged there is little incentive for AMD to force down pricing in 2026.

It appears that the trend towards AI could continue to evolve for a decade or more before leveling off. Nvidia points out that company after company that is pursuing advanced AI software is shifting to GPUs where Nvidia has a significant early lead (with AMD in hot pursuit and Intel and others lagging). As Nvidia locks up customers they appear well positioned to retain them as long as they maintain a solid competitive position. And as the early leader, the company has secured a massive number of customers.

In general, the cost of manufacturing chips declines as a product matures so even if pricing declines, gross margins could remain close to where they currently are. Intel is also working on becoming a leader in AI. It has several products and numerous customers but appears to be well behind Nvidia and AMD. The other strong competitive advantage that Nvidia maintains is the number of developers creating applications using its platform is about 5 million, dwarfing any competitor. This was the key for Microsoft Windows to win in the PC space and Apple to win in smart phones.

For now, we believe Nvidia will continue its momentum throughout 2026 and beyond. Given that demand is growing rapidly (there are forecasts that 80% of all PC sales will be AI enabled in 4-5 years) pricing pressure that causes significant GM decline appears unlikely to emerge in the next 2-3 years. As we saw in the PC space (where Intel controlled things), as pricing on older chips declined, users tended to buy newer technology meaning that instead of paying less for the older product they paid what they had before for a more powerful product. It appears that the AI space is still young enough to replicate this trend.

7. AMD will outperform the market (it closed at $214.16 per share on December 31, 2025)

AMD has emerged as the closest competitor to Nvidia with technology that rivals it in performance. While Nvidia secured many customers with its early technical lead, AMD is now making it more of a two-horse race. To be clear, AMD still has a small market share for AI chips (Nvidia forecast revenue is expected to be about 7 ½ times the size of AMDs in Q4 2025). This is why (over the next few years), AMD can raise revenue at a high rate without having a major impact on Nvidia growth levels. The reason that we believe AMD can’t make a leap in revenue (of over 100% in a given year) is its sales volumes not only depend on the quality of the technology but also on manufacturing capacity. Given how expensive and time-consuming it is to build capacity, ramping up volume takes time. Additionally, AMD is not the “pure play” in AI that Nvidia is since it also has a major business in chips for PCs and older server technology.

AMD revenue grew by almost 36% in Q3 up from 32% in Q2 of 2025. Growth could expand further as the company ramps capacity. In October 2025 AMD announced a multi-year agreement with OpenAI. The deal is expected to bring AMD tens of billions of dollars in revenue. It also gives OpenAI the ability to acquire up to 10% of AMD stock if OpenAI meets certain deployment options. The announcement solidified AMDs position in the AI chip space and led to a meaningful increase in its stock price. The collaboration also includes joint efforts to improve AMD ROCm software to make it more competitive with Nvidia’s CUDA software for AI training. Given this and other signings, AMD revenue and earnings growth appears likely to expand in 2026.

Like Nvidia, AMD suffered from US policy regarding shipping to China. Revenue was impacted, reducing growth and leading to a write-off of about $800 million for inventory and related charges. Like Nvidia, part of this write-off could be reversed going forward as the company resumes shipping to China (Q4 guidance assumed 0 revenue from sales to China but the hold on selling to China has been lifted).

AMD has also benefited from Intel’s highly publicized woes as it has gained share in the traditional PC market. We expect older PC technology to continue to exist for some time but market growth in that area to be limited.

2025 Non-Stock Predictions

8. The Housing market will experience increased unit sales in 2026

Am I a glutton for punishment or a patient forecaster? Last year I was counting on a substantial decrease in interest rates, spurring a comeback in home sales. Instead, mortgage rates, which started the year at about 7.0%, were still at about 6.7% for much of the year. But mortgage rates started falling as the Fed interest rate began going down (late in the year) and decreased to about 6.15% in December. As discussed in our 2025 prediction recap above, an increase in construction of new homes coupled with more existing homes coming on the market meant inventory of homes for sale reached their highest level since pre-pandemic days by year end 2025. So, while home sales only increased slightly in 2025, we believe the stage has been set for a greater increase in 2026.

9. Autonomous driving will become more prevalent in 2026

While Waymo has already deployed fleets of autonomous taxis in several locations, their technology relies heavily on Lidar making it an expensive vehicle to create. Tesla’s technology for autonomous driving relies on its AI software coupled with sensors and cameras resulting in a vehicle cost 80-90% less expensive. Tesla now appears quite close to reaching the point where FSD (full self-driving) can be safer than a human controlled vehicle.

There is currently controversy over whether this is already valid. However, the test of its reliability is now occurring with Tesla’s Robotaxi launch in Austin. Tesla has also received approval for testing in Arizona and Nevada. In Austin some test rides are now operating without a human monitor in the vehicle. These are the first true tests of the reliability of FSD in a reasonably priced vehicle. (Note: Waymo has already proven effective at a very high-cost vehicle that few could afford.) We believe Tesla is close enough that by mid-2026 it could get approval of rolling out Robotaxis without human monitors in Austin.

If Tesla is successful at such a launch, what follows will be a complete test to assess the safety of FSD versus human drivers as a safety record will be established. Clearly, establishing this for the Robotaxi will be the long-awaited proof point that FSD is effective and will lead to added safety. What should follow is wider adoption of the technology in autos in general as the Tesla technology is at a price point where individual drivers will be able to afford it.

10. Bitcoin will have a strong 2026 (it closed 2025 at 87,508).

There are several reasons bitcoin should be strong in 2026. First, it typically moves in spurts but generally the direction has been up – yet in 2025 it closed lower than it was when the year started (it was 93,460 on Dec 31, 2024). So, assuming historical patterns prove correct it is theoretically positioned for a move up.

Secondly, bitcoin is more complex to mine every year (as computers become more powerful this is done to adjust for that). Therefore, bitcoin miners need to spend more on their facilities and this has made it harder for them to profit given the lack of increase in bitcoin prices. With fewer miners, new supply will not be introduced at the same pace that demand is expected to grow. When supply increases more slowly than demand prices usually rise. A second reason miners are leaving is that they can profit by using their facilities for AI. So, in a sense the opportunities to use sophisticated facilities in multiple ways creates competition for the facility. Assuming the price of bitcoins does not increase new supply will keep shrinking. This should in turn cause bitcoin prices to go up as the price needs to reach a point where it is sufficient to stimulate production of enough coins to meet demand.