…and why the obvious probably won’t happen!

A Look at Apple history

Apple’s progress from a company in trouble to becoming the first company to reach a trillion dollar market cap meant over 400X appreciation in Apple stock. The metamorphosis began when the company hired Fred Anderson as an Executive VP and CFO in 1996. Tim Cook joined the company as senior VP of worldwide operations in 1998. Fred and Tim improved the company operationally, eliminating wasteful spending that preceded their tenure. Of course, as most of you undoubtedly know, bringing back Steve Jobs by acquiring his company, NeXT Computer in early 1997 added a strategic genius and great marketer to an Apple that now had an improved business model. Virtually every successful current Apple product was conceived while Steve was there. After Fred retired in 2004, Tim Cook assumed even more of a leadership role than before and eventually became CEO shortly before Jobs’ death in 2011.

Apple post Steve Jobs

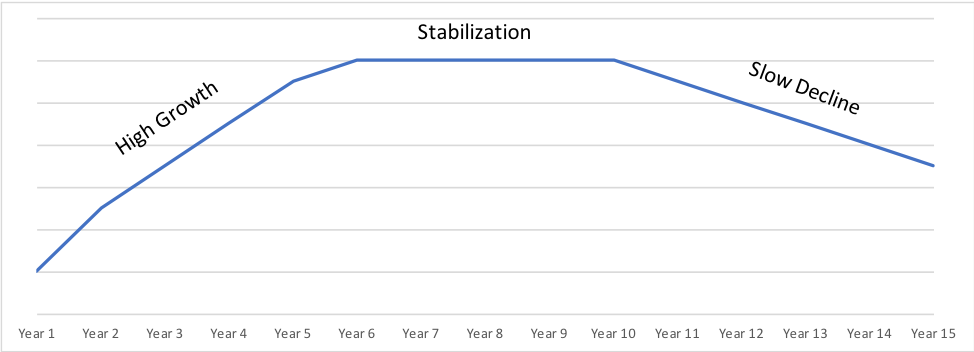

Tim Cook is a great operator. In the years following the death of Steve Jobs he squeezed every bit of profit that is possible out of the iPad, iPod, iMacs, music content, app store sales and most of all the iPhone. Because great products have a long life cycle they can increase in sales for many years before flattening out and then declining.

Table 1: Illustrative Sales Lifecycle for Great Tech Product

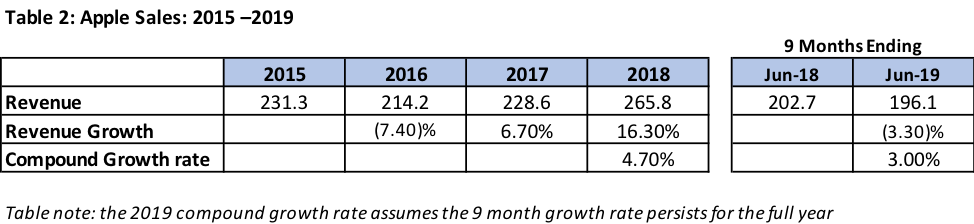

Cook’s limit is that he cannot conceptualize new products in the way Steve Jobs did. After all, who, besides an Elon Musk, could? The problem for Apple is that if it is to return to double digit growth, it needs a really large, successful new product as the iPhone is flattening in sales and the Apple Watch and other new initiatives have not sufficiently moved the needle to offset it. Assuming Q4 revenue growth in FY 2019 is consistent with the first 9 months, then Apple’s compound growth over the 4 years from FY 15 to FY 19 will be 3.0% (see Table 2) including the benefit of acquisitions like Beats.

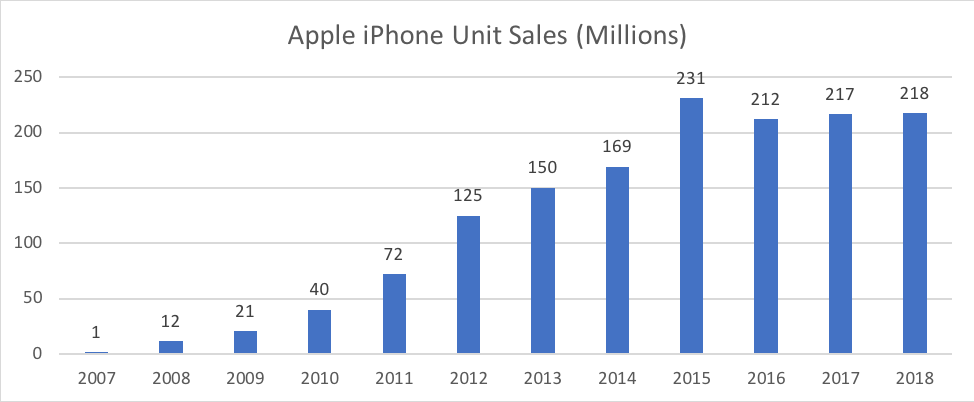

iPhone sales have flattened

The problem for Apple is that the iPhone is now in the mature part of its sales life cycle. In fact, unit sales appear to be declining (Graph 1) but Apple’s near monopoly pricing power has allowed it to defy the typical price cycle for technology products where average selling prices decline over time. The iPhone has gone from a price range of $99 to $299 in June 2009 to $999 to $1449 for the iPhoneX, while the older iPhone 7 is still available with minimal storage for $449. That’s a 4.5X price increase at the bottom and nearly 5X at the high end! This defies gravity for technology products.

Graph 1: iPhone Unit Sales (2007-2018)

In the many years I followed the PC market, it kept growing until reaching the following set of conditions (which the iPhone now also faces):

- Improvements in features were no longer enough to drive rapid replacement cycles

- Pricing was under pressure as component costs declined and it became more difficult to convince buyers to add capacity or capability sufficient to hold prices where they were

- The number of first time users available to buy product was no longer increasing each year

- Competition from lower priced suppliers created pricing pressure

Prior to that time PC pricing could be maintained by convincing buyers that they needed one or more of:

- The next generation of processor

- A larger or thinner screen

- Next generation storage technology

What is interesting when we contrast this with iPhones is that PC manufacturers struggled to maintain average selling prices (ASPs) until they finally began declining in the early 2000s. Similarly, products like DVD players, VCRs, LCD TVs and almost every other technology driven product had to drop dramatically in price to attract a mass market. In contrast to that, Apple has been able to increase average prices at the same time that the iPhone became a mass market product. This helped Apple postpone the inevitable revenue flattening and subsequent decline due to lengthening replacement cycles and fewer first time buyers. In the past few years, other then the bump in FY 2018 from the launch of the high priced Model X early that fiscal year, iPhone revenue has essentially been flat to down. Since it is well over 50% of Apple revenue, this puts great pressure on overall revenue growth.

To get back to double digit growth Apple needs to enter a really large market

To be clear, Apple is likely to continue to be a successful, highly profitable company for many years even if it does not make any dramatic acquisitions. While its growth may be slow, its after tax profits has been above 20% for each of the past 5 years. Strong cash flow has enabled the company to buy back stock and to support increasing dividends every year since August 2014.

Despite this, I think Apple would be well served by using a portion of their cash to make an acquisition that enables them to enter a very large market with a product that already has a great brand, traction, and superior technology. This could protect them if the iPhone enters the downside of its revenue generating cycle (and it is starting to feel that will happen sometime in the next few years). Further, Apple would benefit if the company they acquired had a visionary leader who could be the new “Steve Jobs” for Apple.

There is no better opportunity than autos

If Apple laid out criteria for what sector to target, they might want to:

- Find a sector that is at least hundreds of billions of dollars in size

- Find a sector in the midst of major transition

- Find a sector where market share is widely spread

- Find a sector ripe for disruption where the vast majority of participants are “old school”

The Automobile industry matches every criterion:

Matching 1. It is well over $3 trillion in size

Matching 2. Cars are transitioning to electric from gas and are becoming the next technology platform

Matching 3. Eight players have between 5% and 11% market share and 7 more between 2% and 5%

Matching 4. The top ten manufacturers all started well over 50 years ago

And no better fit for Apple than Tesla

Tesla reminds me of Apple in the late 1990s. Its advocates are passionate about the company and its products. It can charge a premium versus others because it has the best battery technology coupled with the smartest software technology. The company also designs its cars from the ground up, rather than retrofitting older models, focusing on what the modern buyer would most want. Like Jobs was at Apple, Musk cares about every detail of the product and insists on ease of use wherever possible. The business model includes owning distribution outlets much like Apple Stores have done for Apple. By owning the outlets, Tesla can control its brand image much better than any other auto manufacturer. While there has been much chatter about Google and Uber in terms of self-driving cars, Tesla is the furthest along at putting product into the market to test this technology.

Tesla may have many advantages over others, but it takes time to build up market share and the company is still around 0.5% of the market (in units). It takes several years to bring a new model to market and Tesla has yet to enter several categories. It also takes time and considerable capital to build out efficient manufacturing capability and Tesla has struggled to keep up with demand. But, the two directions that the market is moving towards are all electric cars and smart, autonomous vehicles. Tesla appears to have a multi-year lead in both. What this means is that with enough capital and strong operational direction Tesla seems poised to gain significant market share.

Apple could accelerate Tesla’s growth

If Apple acquired Tesla it could:

- Supply capital to accelerate launch of new models

- Supply capital for more factories

- Increase distribution by offering Tesla products in Apple Stores (this would be done virtually using large computer screens). An extra benefit from this would be adding buzz to Apple stores

- Supply operational knowhow that would increase Tesla efficiency

- Add to the luster of the Tesla brand by it being part of Apple

- Integrate improved entertainment product (and add subscriptions) into Tesla cars

These steps would likely drive continued high growth for Tesla. If, with this type of support, it could get to 5% share in 3-5 years that would put it around $200 billion in revenue which would be higher than the iPhone is currently. Additionally, Elon Musk is possibly the greatest innovator since Steve Jobs. As a result, Tesla would bring to Apple the best battery technology, the strongest power storage technology, and the leading solar energy company. More importantly, Apple would also gain a great innovator.

The Cost of such an acquisition is well within Apple’s means

At the end of fiscal Q3, Apple had about $95 billion in cash and equivalents plus another $116 billion in marketable securities. It also has averaged over $50 billion in after tax profits annually for the past 5 fiscal years (including the current one). Tesla market cap is about $40 billion. I’m guessing Apple could potentially acquire it for less than $60 billion (which would be a large premium over where it is trading). This would be easy for Apple to afford and would create zero dilution for Apple stockholders.

If the Fit is so strong and the means are there, why won’t it happen?

I can sum up the answer in one word – ego. I’m not sure Tim Cook is willing to admit that Elon would be a far better strategist for Apple than him. I’m not sure he would be willing to give Elon the role of guiding Apple on the product side. I’m not sure Elon Musk is willing to admit he is not the operator that Tim Cook is (remember Steve Jobs had to find out he needed the right operating/financial partners by getting fired by Apple and essentially failing at NeXT). I’m not sure Elon is willing to give up being the CEO and controlling decision-maker for his companies.

So, this probably will never happen but if it did, I believe it would be the greatest business powerhouse in history!

Soundbytes

- USA Today just published a story that agreed with our last Soundbytes analysis of why Klay Thompson is underrated.

- I expect Zoom Video to beat revenue estimates of $129 million to $130 million for the July Quarter by about $5 million or more