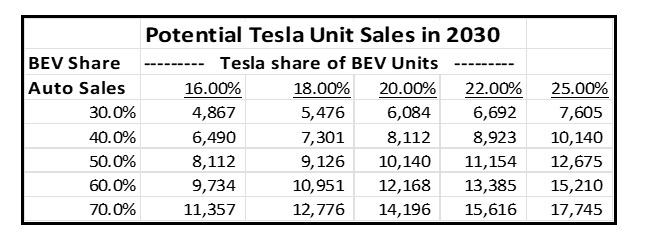

What does that mean for Tesla and others?

EVs include both BEVs (Battery Electric Vehicles) and PHEVs (Plug-In Hybrid Electric Vehicles). We’ll start with a top-down view and then go into substantial detail regarding Tesla followed by some overall discussion of Rivian and Lucid.

California is taking the lead in banning sales of new gas-powered cars by 2035.

In August 2021, President Biden issued an Executive Order setting a target that by 2030, 50% of all new vehicles sold in the US will be net zero emitters of greenhouse gasses. He has recently added a goal of 60% by 2032. California has drawn a line in the sand regarding legislating the end of gas-powered vehicles. A measure approved by the California Air Resources Board requires all new light vehicles (passenger cars, SUVs and pick-up trucks) sold in the state in 2035 or later to generate zero emissions. It is a little unclear whether this will allow PHEVs to be sold, as they do generate emissions, but my reading suggests that PHEV models that can be charged at a charging station are probably not currently part of the ban. I expect this to change and believe PHEVs will be banned as well or fall to minimum sales once the conditions for BEVs described below are met. Six other states have already followed California’s lead: Maryland, Massachusetts, New Jersey, New York, Oregon, and Washington. Numerous other states are in the process of considering moving in the same or an even more aggressive direction.

I believe that most of the country and the rest of the world will follow in this direction (unless lobbying efforts slow progress) as the following issues are already or likely to be met by 2030:

- BEVs must offer enough driving range to make buyers comfortable;

- BEVs with the right characteristics need to become more affordable;

- There must be close to the same access to charging stations as gas cars have to gas stations.

Driving Range on dozens of BEVs will likely exceed 500 miles by 2030.

For perspective consider that (according to Electrek) in 2012 there were only 9 EVs available, 8 of which were Hybrids that, on average, could only drive about 70 miles on the battery. The 9th was the Tesla Model S which had a range of 265 miles but cost about $90,000. As late as 2016, there was still only one pure BEV with a driving range of over 300 miles, the Tesla Model S. By 2021, this number had expanded to 5, 3 of which were Tesla models. As of August 2023, there are 14 models with that range including 4 from Tesla, 2 from Rivian and one from Lucid. Lucid has the longest range, 520 miles, but the two Rivians and the Tesla Model S Long Range all are over 400 miles. The list includes 2 models from Ford, two from BMW, plus one each from Mercedes, Kia and Hyundai. What this suggests is that further increases in driving range are not only possible but extremely likely (in fact preliminary reports indicate the next version of the Tesla Model 3 due in 2024 will move to over 400 miles of driving range). I believe that in 7 years, or even sooner, there will be numerous models that have a range of over 500 miles, including all Tesla models, all Rivians and all Lucids. This is a technology issue and as we’ve seen with computers and phones, technology delivers better performance every year.

Affordability is already here…sort of!

The standard Model 3 is listed on Tesla’s website as having a manufacturers suggested retail price of $32,740 after the federal EV tax credit. But California also provides a state tax credit of $7500. After that credit the price drops to $25,240, $1,000 less than a gas-powered Toyota Camry. That doesn’t even consider the lower cost of service and fuel, or the higher resale value of the Tesla. This has led to the Model 3 replacing the Camry as the best-selling car in California, This depends on tax credits so we’re not quite at parity yet on affordability but given the trend we should be in several years.

Charging availability is increasing rapidly.

According to the Department of Energy, the number of charging stations in the US increased from 5,070 in 2011 to 143,711 at the end of 2022. This represents a compound annual growth rate of about 35.5%. The stations have also improved in their speed to charge. It is also easy to install a power line at home to be able to charge the vehicle every night, eliminating the need to use a charging station other than for long trips. Gas powered cars do not offer this convenience. For example, my wife and I recently went from our home in Atherton to Napa for a weekend, a distance of about 90 miles each way. In total, including visiting wineries and restaurants, we drove 340 miles. We never charged the car during the trip as her Tesla’s range is over 400 miles. There are currently over 145,000 gas stations in the US. The number of locations with charging stations now exceeds 54,000. At the historic growth rate of over 35% this would mean that the number of charging locations could exceed the number of gas stations by the end of 2026. It is also likely that the number of gas stations could decline as the install base of gas-powered vehicles declines.

Sales of BEVs have reached an inflection point.

In 2022 worldwide sales of light vehicles (passenger cars, SUVs and pickup trucks) EVs reached over 10.5 million units, up 55% year/year. This occurred despite the sales of all light vehicles declining slightly versus 2021.

To understand where this is going, we initially need to produce a forecast for total light vehicle unit sales (which, for simplicity we’ll refer to as “cars”) in 2030. I have assumed that by 2026 global unit sales would return to 2018 levels which was 93.7 million according to IHS Markit. I then assumed the volume would grow by 2% per year through 2030. Some would argue that given population growth, matching 2018 volumes 3 years from now is too conservative. Others will say we will not get back to that level. I believe this to be a middle of the road assumption.

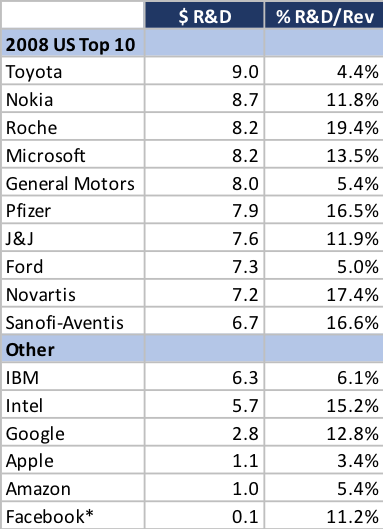

The second question is what share will BEVs be of total auto sales? In the table below I show a range that varies from 30% to 70% (BEVs are over 10% in 2023). If we apply the Biden 50% minimum goal for the US to worldwide sales, then the 2030 number would be 50% of 101.4 million units or 50.7 million units. This would mean an 8-year compound growth rate of 26.6% for unit sales of BEVs (it grew about 60% in 2022). Obviously, this is not an exact science!

I expect Tesla unit sales to be about 8X 2022 levels in 2030.

In 2022 Tesla sold over 1.3 million BEV autos which was 17.1% of the BEV market. That is far from the full story as they did not participate in several large categories of vehicles: pickup trucks, low-cost autos, and sports cars. Their share was over 30% in the categories they did participate in. I believe that by 2030 Tesla will have added all three of these categories to its lineup. If we take the middle row and column of the above chart: BEVs have 50% market share and Tesla sells 20% of BEVs (which is 1/3 share lower than they currently have in categories in which they participate). That would mean Tesla will sell 10.14 million vehicles in 2030. If they did, the company would have an 8-year CAGR of 29%. This is well below the 50% growth they are tracking towards this year but of course the law of large numbers predicts a decline in high growth rates.

Tesla Stock did not reflect strong expectations in 2022.

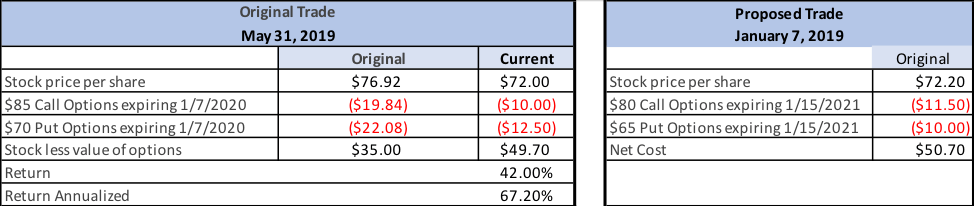

Despite revenue growth of over 50%, Tesla was one of the worst stocks in 2022. Partly this was due to fears that Elon’s acquisition of Twitter would be a distraction, partly it was due to the backlog shrinking and partly it was due to Elon liquidating a number of shares to finance the Twitter acquisition. In H1 2023 Tesla was one of the best stocks in the market (appreciating over 110%) as the backlog began to (slightly) expand again, Elon stopped selling shares (and promised to hold his position for the rest of 2023) and the Twitter acquisition became less of an issue to investors. It should be noted that as of September 10, Tesla shares have slipped by about 5% from the June 30 value over new fears that Tesla price cuts were hurting earnings. It was obvious to us that the price cuts were to leverage superior manufacturing cost and drive increased volume and this has in fact occurred, but Tesla will remain a volatile stock which is why premiums on Tesla calls are quite high.

Unlike some, we believe Tesla was smart to raise prices substantially in 2021 and 2022 while they could not meet demand. Then we believe they were smart to lower prices once their manufacturing capacity expanded, and backlog shrunk to a more normal level. Lowering prices places tremendous stress on the competition as Tesla has significant margin advantages over its competitors. Its net margins are still strong at lower prices, but many competitors don’t have the room to maintain margins at lower prices. Additionally, lowering prices on Tesla mass market vehicles meant that many Model Ys and Model 3s qualified for the US $7500 tax credit for electric vehicles that started on January 1, 2023. Nonetheless, the level of price decreases is worth monitoring as it does lower Tesla gross margins.

We expect Tesla unit sales to increase 45% to 55% in 2023.

Despite rising slightly in H1, the decrease in the Tesla backlog remains a concern to investors. At year end it was at about 44 days of production (or roughly ½ of units sold in Q4). While there are many elements to consider, some investors have a concern that it will be difficult for Tesla to achieve or exceed its target of 40% vehicle sales unit growth in 2023. Given already announced sales in Q2, Tesla unit sales were up 60% in H1. However, this includes a very weak comp in Q2 2022 due to China being closed for part of Q2 last year. Still if the company merely replicates Q2 sales in Q3 and Q4 for existing vehicles and adds sales of the Cybertruck to this total, 2023 growth would exceed 45%. There are several factors that indicate they are likely to continue to increase sales sequentially:

- In Q2 Tesla actually shipped more cars than it produced despite increasing production, while backlog remained relatively stable.

- Historically Tesla has seen demand increase sequentially in virtually every quarter. If we assume a 7% increase going forward, then units will be up over 50% year over year in 2023 without any Cybertruck sales.

- The Tesla CyberTruck has a waitlist that exceeds 1.5 million vehicles. On August 16 Electrek reported that “truckloads” of Cybertrucks were spotted being delivered. These would not be for consumers but rather for final testing. Tesla has indicated that it will be hosting a launch date for the vehicle and speculation is that it will be quite soon. They then will begin building towards volume production starting in Q4. If existing product sales fall short of the 7% sequential increase in Q3 and Q4, sales of the CyberTruck could make up for the difference as these sales will be incremental to the current run rate for existing vehicles.

- The company now has the manufacturing capacity to increase volumes – the question will be parts supply and whether demand will be strong if the economy goes into a recession.

Despite a reduction in its backlog in 2022, demand for its vehicles continues to increase. As you hear of new competition in the electric vehicle market keep in mind that Tesla share of the US market for ALL cars is still only about 3% and in China and Europe it remains under 2%. As a comparison Toyota worldwide market share is over 13% and VW is not far behind. We estimate that Tesla’s share of BEVs in the categories it plays in is over 30%. Once it launches the Cybertruck it will increase its available market (TAM) substantially. But it will still need to launch a low-priced vehicle (in the $25,000 – $30,000 range) and a sports car (which it is working on) over the next 3-5 years to address the total market. As the world transitions to electric vehicles, we expect Tesla’s share of all auto sales to rise substantially even as it declines in dominance of the electric vehicle market. When the CyberTruck begins shipping, Tesla total backlog is likely to increase to over 1.6 million vehicles. And the CyberTruck current backlog isn’t expected to be fulfilled until late 2027!

Tesla Margins

Tesla gross margins declined in Q1, as price decreases had an impact. In Q2 Tesla made further price decreases but this was partially offset by improved efficiency in newly launched factories in Berlin and Texas. While lower vehicle prices in 2023 and increasing cost of parts will place some pressure on gross margins, we still believe they will continue to remain by far the highest of any auto manufacturer:

- Tesla, like Apple did for phones, is increasing the high margin software and subscription components of sales;

- Add-on sales are likely to offset a portion of price decreases;

- As its new factories ramp they will increase their efficiency; and

- Tesla will have lower shipping cost to European buyers as the new Berlin factory reaches volume production.

- A decline in gross margins can be at least partly offset by SG&A declining as a percentage of sales as revenue growth is likely to be higher than any increase in SG&A.

Revenue in the Semi category could surpass $10 billion in a few years.

To date the Tesla Semi has been produced in very small volumes and limited production capacity will mean deliveries will remain low during the next few quarters. We believe the ramping of Semi production will begin in late 2024 as the company only has a small number in customers’ hands today (essentially for test purposes). However, given its superior cost per mile the Semi is likely to become a major factor in the industry. Despite its price starting at $150,000, its cost per mile appears lower than any competitive products. Given potential of up to $40,000 in US government incentives the competitive advantage over diesels will be even greater. The company is expecting to increase production to about 50,000 per year by some time in 2025 (which would represent potential incremental high margin annual sales in the $8-$10 billion range). While this is ambitious, the demand could exceed that as it represents a single digit percent of the worldwide market for a product that should have the lowest cost/mile of any in the semi category.

Tesla Expects to launch a new Roadster in 2024

The new version of the roadster is being developed but it’s unclear when it will be ready for production as the target date has slipped multiple times. Right now, Tesla expects the launch to be in 2024. Once it launches, it will become another source of incremental demand at high margins. The early claims are that it will have a driving range of over 600 miles (at reasonable speeds), a top speed of 250 miles/hour, go zero to 60 in 1.9 seconds and cost about $200,000 for the standard model. This would make it faster than a McLaren.

The Bottom Line: Tesla should continue to have accelerated revenue growth in Autos.

This all points to solid revenue growth continuing (but at a lower level than unit sales growth in 2023), strong GMs in 2023 and beyond, and earnings escalation likely faster than gross margin dollar growth. While the company has reduced pricing, the ability to sell greater dollars in software should help maintain strong AOV and gross margins.

Tesla is not a one trick pony – it has several other potentially large revenue streams.

There are numerous other revenue sources for Tesla, especially on the energy side given its strong solar offerings and best-in-class power walls. Tesla also is a leader in automated driving and should that reach commercialization for “driverless taxis/driver services” the company is well positioned to add a substantial revenue stream. The discussion above regarding charging stations did not include the fact that Tesla is the runaway leader in this category (it just reached 50,000 units deployed) and its technology is probably going to become the standard. So, while I believe the vast majority of charging will take place in the home, Tesla will add another revenue stream from their infrastructure. Recently GM, Ford and Rivian have all decided to move to the Tesla charging technology.

Finally, there is some possibility that Tesla’s Optima Robot project will, at some point in the future, lead to launching smart robots that can perform numerous tasks. The company has taken its AI developed for autos as well as the variety of sensors integrated into a vehicle and transformed them to apply to robotics. At their AI day 11 months ago, they were able to demonstrate a humanoid alpha version that could walk with knowledge of what was in front of it and around it. The robot could also pick up objects and perform other simple tasks. We expect a significant leap forward at this year’s AI day scheduled for September 30. Elon, who tends towards optimistic thinking, has stated that he believes revenue from the Optima could exceed Auto revenue at some point in time!

A few comments on Rivian.

Rivian has gotten quite a bit of press regarding its opportunity to be one of the leaders in BEV pickup trucks and SUVs. The Rivian R1T electric pickup truck has recently earned the J.D. Power award for the most satisfying experience among BEVs (Tesla was second). The study, released in February, benchmarked EV owner satisfaction with critical attributes that affect the EV ownership experience. Reviewing 2022 and 2023 model year battery electric and plug-in hybrid vehicles, EV owners found R1T to be best among premium battery electric vehicles for driving enjoyment, vehicle quality and reliability, service experience, interior/exterior styling, cost of ownership, ease of charging at home and accuracy of stated battery range.

Cars.com reviews gave Rivian a 5.0 out of 5.0 rating with 100% of customers saying they would recommend it. A second review site, Edmunds, with a minimal number of reviews, was less favorable as most reviewers rated it highly, but several reviewers liked the vehicle but were dissatisfied with the quality of service. We believe the JD Power survey to be the most reliable. The strong customer experience positions the company for accelerated top line growth. In Q2 revenue was up over 200% year/year and unit sales increased 59% sequentially. Rivian also increased their guidance of how many vehicles they will ship this year to 52,000. Despite the Ford F150 pickup being touted as the clear leader in the category, CNBC reported that Rivian actually sold more electric pickup trucks in the US in H1 than anyone else. In a recent survey by Car Guru, 43% of potential truck buyers said they favored buying an electric vehicle.

Rivian also has an order to build 100,000 electric vans for Amazon. Amazon says it has taken delivery of 5,000 already and I have recently seen a few on the road in the SF Bay Area. I asked the driver of one what she thought of the product. Her reply was that it was quite an improvement versus her prior van. In searching for other products that compete there appear to be numerous others manufacturing this type of product. It’s hard to tell if the Rivian van has an overall advantage but it does seem to have the longest range of any that I found. This appears to be a very large opportunity for Rivian as the price of its vans start at $60,000 so the existing Amazon order is worth at least $6 billion (5.4X Q2 Rivian revenue) and Amazon could decide to expand the order. The fact that its competitors does not include Tesla puts Rivian in a strong position.

Given the quality of its vehicles, Rivian is well positioned to scale if they can fix their economics. In Q2 gross margins on its vehicles improved by $35,000/vehicle over a year earlier but still came in at a loss of $412 million. If the company can move to profitability (a target it expects to reach in late 2024) without compromising vehicle quality, it could be a very strong performing stock. The risk that they don’t get there before running out of cash has kept the stock value low.

Lucid appears to be struggling.

Lucid produces a very high-end electric sedan that directly competes with the Tesla Model S. The Lucid Air is more luxurious and has a longer driving range than the Tesla but also costs more. The product gets great reviews from magazines like Car & Driver who said: “ As luxury electric sedans go, the Air is a home run, delivering a posh overall experience with an unbeatable driving range.” Given such accolades many thought the Air would be a worthy competitor to Tesla. However, consumers have not embraced the product as their reviews are just OK. Cars.com reviewers gave it an average rating of 3.3 out of 5 and only 46% of those reviewed said they would recommend it. As a comparison the Tesla Model S received a 4.0 average rating and 80% of reviewers said they would recommend the car. Admittedly, the number of reviews was small, but this is still an issue for Lucid.

Lucid appears to have lost momentum in the marketplace as Q2 sales of 1,404 units were flat compared to Q1 and fell well short of Wall Street expectations of 2,000 units. This also put into question whether Lucid was successfully converting the 28,000 reservations it had previously disclosed.

On the positive side, Lucid is extremely well funded and struck two interesting deals in the quarter:

- To supply Aston Martin with power trains, battery systems and related technology in a deal worth $232 million.

- To begin sending cars to Saudi Arabia which may help relieve the company’s inventory build up as it produced over 1,700 more vehicles than it sold in H1.

Both deals must be taken with a grain of salt as the Saudi Arabia Public Investment Fund is a major backer of both Lucid and Aston Martin.

Lucid will be launching new lower priced vehicles going forward so it still remains a company with potential given its ample capital, quality technology and well-designed vehicle. But, unlike Rivian which has carved out a niche where Tesla is not a direct competitor (now or in the near future), Lucid will have to find a way to be more successful versus this dynamo.