A friend called me the other day and inquired as to whether I was ok, as I had not posted in several months. While my goal has been to do about 10 blog posts per year, my frequency has always been erratic, and this year has really been sparse. To make things up, I am going to try for 2 new posts in the next 3 weeks or so that stem from the Azure Marketing Day, held each year for our portfolio companies to gain exposure to advanced techniques across multiple marketing areas. Since the speakers are truly knowledgeable of their arena, using one or two talks as a basis of a post makes me look good!

This post will focus on branding and how to measure whether it is working. The next will delve into direct (snail mail) marketing and how some companies are finding it quite effective.

How to measure the efficacy of brand campaign spend

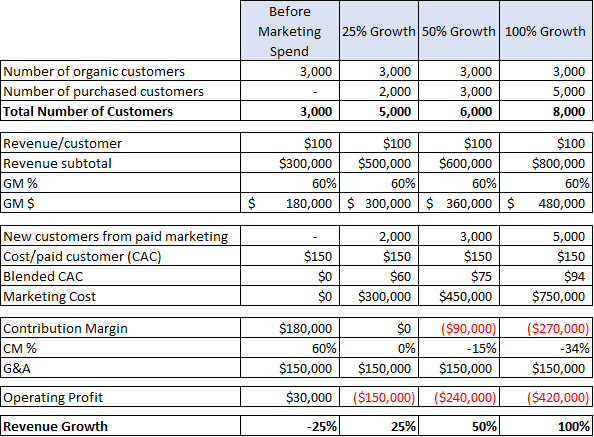

Spending on branding is quite different than spending for customer acquisition. While many ads serve both purposes, the difference is based on whether there is a direct call for action…usually to buy something. For simplicity, I assume that if there is a call for action, the ad is for customer acquisition, if there is no call for action the ad is for branding.

By improving their brand, a company can experience:

- Higher conversion rates on its customer acquisition spend

- An increase in the number of people who visit their site

- An increase in the LTV (lifetime value) of customers

One method of measuring whether a branding campaign is effective is to determine whether people in the geography where the marketing takes place become more aware of the brand. This is done by measuring the awareness of the brand both before and after the campaign. The most common measure for younger companies is called “Aided Brand Awareness”. Aided brand awareness is determined by conducting a survey of a statistically significant random sample of the population of the geography. In the survey, each person is asked to say which of a list of products/companies they recognize. The percentage that picks the product or company as one they know of is designated as the Aided Brand Awareness. Most TV ads are for improving brand awareness, whereas a large proportion of online ads are for customer acquisition.

While it may seem surprising now, when I was on Wall Street covering Microsoft (and others), Bob Herbold, Microsoft COO, believed a lack of universal brand awareness was limiting the company. So, Microsoft engaged in a significant spend to raise its brand awareness from well below 50% (as I recall) before the campaign. It was one of the many smart strategies the company used to become what they are today. An improved brand helped drive a massive gain in market share for Microsoft productivity applications.

At the Azure Marketing Day, Chris Bruzzo, EVP Marketing and Commercial at Electronic Arts, provided a session on the importance of branding. He outlined one method of testing the potential effectiveness of a branding campaign without breaking the bank. He suggested, if possible, to start by picking matched geographies for a test. You then conduct the branding campaign in the test location and compare results to the control (the second location). By limiting the test to a few geographies, the cost can be kept reasonable while acquiring information on how much impact a branding campaign could have on your company. EA found advertising to improve its brand was quite effective. While I can’t cite EA data due to a public company’s need for confidentiality, I can say it led to higher customer Life Time Value and an increase in the success of customer acquisition campaigns in the test geographies. I have been given permission to review a similar test conducted by Azure portfolio company Chairish.

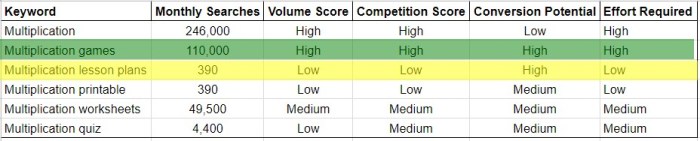

Chairish recently conducted a test of whether spending on branding would prove beneficial. They decided to select 3 cities for the test. For confidentiality, I’ll refer to them as Test Cities 1, 2 and 3. Each was measured against a control city where no branding spend was done. The paired cities, control cities 1, 2 and 3, respectively, each had similar population demographics to the test city it was paired with. The first measurement of benefit was the change in Aided Brand Awareness. Pre-campaign the test cities averaged 6% awareness and the control cities 8%. Post campaign the test cities increased to 13% awareness and the control cities to 9%. So, the lift for the test cities was 7% and for the control cities 1%. I believe that the control cities represented the natural gain the company was getting without a branding campaign, while the branding campaign added an additional 6% of the population to those aware of its brand.

Comparing Test Cities to Control Cities for Branding Campaign

The table shows the average benefit of the marketing campaign across the test cities when compared to their matched control. For example, during the test period the increase in average overall revenue was 23% greater in the test cities than in their paired control locations. A month later, the difference in gain had improved to 25.8%. The reason for such large revenue gains stems from some of the other metrics measured, especially the massive gain in registrations because of the branding campaign.

Given these results, Chairish will be increasing its spend on branding. For those of you who decide to try a branding campaign, it is important to make sure you can measure results. Once the results are in hand, the next step is to compare revenue and gross margin dollar gains to the cost of the campaign. This allows a company conducting a branding campaign to understand the initial incremental cost and the time to recover the investment. Having that in hand allows for a reasonable forecast of the cash flow implications of increasing the spend for branding. One caveat is, while hard to forecast, there is also often the benefit of an increase in customer LTV (life-time value) as greater awareness of the brand also spurs more visits (and spend) from existing customers but this is more difficult to measure in the short run.

While mature companies typically spend a portion of advertising on branding and conduct these types of Aided Brand Awareness measures many younger companies do not consider this. As companies cross the $20-30 million threshold, we believe they should consider experimenting with a brand spend in the manner discussed in this post. Many will find that it is another valuable tool to use as part of marketing spend.

Soundbytes

In our post on September 10, 2020, A Counter Theory to Potential Recession (during week 26 of Shelter in Place), we advocated a counter-theory to widespread predictions that there would be a recession as the pandemic ebbed, stating:

“Much of the public dialogue concerning the economic effect of Covid19 has centered around the large number of people who have lost income, with the conclusion that the US will potentially experience a continued recession going forward. What seems to be lost in the discussion is that the 90% of the labor force that is employed is saving money at an unprecedented rate. This has occurred partly through fear of future loss of income but mostly by a reduction in spending caused by the virus.”

We estimated that consumers would save trillions of incremental dollars if Covid lasted through year end. And that a large portion of it would subsequently be spent on furniture, luxury items, vacations and more. This is now occurring, leading to substantial increased demand for many goods and services and inflationary pressure.

The pressure of this increased spend coupled with continued supply chain issues due to Covid provides the opportunity to keep prices firm (or even increase them) as demand will outstrip supply in many sectors, possibly through year end.