Bull Markets have Tended to Favor My Stock Picks

This may seem like a repeat of what you have heard from me in the past, but I enter each year with some trepidation as my favored stocks are high beta and usually had increased in value the prior year (in 2019 they were up about 46% or nearly double the S&P which also had a strong year). The fact is: I’m typically nervous that somehow my “luck” will run out. But, in 2020 I was actually pretty confident that my stock picks would perform well and would beat the market. I felt this confidence because the companies I liked were poised for another very strong growth year, had appreciated well under their growth over the prior 2-year period and were dominant players in each of their sub-sectors. Of course, no one could foresee the crazy year we would all face in 2020 as the worldwide pandemic radically changed society’s activities, purchasing behavior, and means of communication. As it turns out, of the 6 stocks I included in my top ten list 3 were beneficiaries of the pandemic, 2 were hurt by it and one was close to neutral. The pandemic beneficiaries experienced above normal revenue growth and each of the others faired reasonably well despite Covid’s impact. The market, after a major decline in March closed the year with double digit gains. Having said all that, I may never replicate my outperformance in 2020 as the 6 stocks had an average gain of an astounding 259% and every one of them outperformed the S&P gain of 14.6% quite handily.

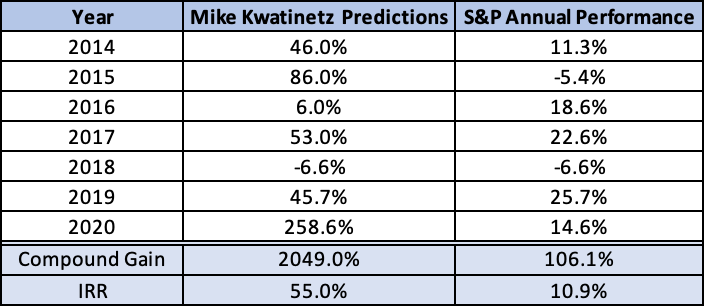

Before reviewing each of my top ten from last year, I would like to once again reveal long term performance of the stock pick portion of the top ten list. I assume equal weighting for each stock in each year to come up with performance and then compound the yearly gains (or losses) to provide the 7-year performance. I’m comparing the S&P index at December 31 of each year to determine annual performance. Soundbyte’s compound gain for the 7-year period is 2049% which equates to an IRR of 55.0%. The S&P was up 106.1% during the same 7-year period, an IRR of 10.9%.

2020 Non-Stock Top Ten Predictions also Impacted by Covid

The pandemic not only affected stock performance, it had serious impact on my non-stock predictions. In the extreme, my prediction regarding the Warriors 2020-2021 season essentially became moot as the season was postponed to start in late December…so had barely over a week of games in the current year! My other 3 predictions were all affected as well. I’ll discuss each after reviewing the stock picks.

The 2020 Stocks Picked to Outperform the Market (S&P 500)

- Tesla Stock which closed 2019 at $418/share and split 5 for 1 subsequently

- Facebook which closed 2019 at $205/share

- DocuSign which closed 2019 at $74/share

- Stitch Fix which closed 2019 at $25.66/share

- Amazon which closed 2019 at $1848/share

- Zoom Video Communications which closed 2019 at $72.20/share

In last year’s recap I noted 3 of my picks had “amazing performance” as they were up between 51% and 72%. That is indeed amazing in any year. However, 2020 was not “any year”. The 6 picks made 2019 gains look like chopped liver as 4 of my 6 picks were up well over 100%, a 5th was up over 70% and the last had gains of double the S&P. In the discussion below, I’ve listed in bold each of my ten predictions and give an evaluation of how I fared on each.

1. Tesla stock appreciation will continue to outperform the market (it closed last year at $418/share). Note that after the 5 for 1 split this adjusts to $84.50/share.

In 2020, Tesla provided one of the wildest rides I’ve ever seen. By all appearances, it was negatively impacted by the pandemic for three reasons: people reduced the amount they drove thereby lessening demand for buying a new vehicle, supply chains were disrupted, and Tesla’s Fremont plant was forced to be closed for seven weeks thereby limiting supply. Yet the company continued to establish itself as the dominant player in electronic, self-driving vehicles. It may have increased its lead in user software in its cars and it continued to maintain substantial advantages in battery technology. The environment was also quite favorable for a market share increase of eco-friendly vehicles.

Additionally, several other factors helped create demand for the stock. The 5 for 1 stock split, announced in August was clearly a factor in a 75% gain over a 3-week period. Inclusion in the S&P 500 helped cause an additional spike in the latter part of the year. Tesla expanded its product line into 2 new categories by launching the Model Y, a compact SUV, to rave reviews and demonstrating its planned pickup truck (due in late 2021) as well. While the truck demo had some snags, orders for it (with a small deposit) are currently over 650,000 units.

All in all, these factors led to Tesla closing the year at $706/share, post-split, an astounding gain of 744% making this the largest one year gain I’ve had in the 7 years of Soundbytes.

2. Facebook Stock will outpace the market (it closed 2019 at $205 per share)

Facebook was one of the companies that was hurt by the pandemic as major categories of advertising essentially disappeared for months. Among these were live events of any kind and associated ticketing company advertising, airlines and cruise lines, off-line retail, hotels, and much more. Combine this with the company’s continued issues with regulatory bodies, its stock faced an uphill battle in 2020. What enabled it to close the year at $273 per share, up 33% (over 2x the S&P), is that its valuation remains low by straight financial metrics.

3. DocuSign stock appreciation will continue to outperform the market (it closed 2019 at $74/share)

DocuSign was another beneficiary of the pandemic as it helped speed the use of eSignature technology. The acceleration boosted revenue growth to 53% YoY in Q3, 2021 (the quarter ended on October 31, 2020) from 39% in Fiscal 2020. Since growth typically declines for high-growth companies this was significant. Investors also seemed to agree with me that the company would not lose the gains when the pandemic ends. Further, DocuSign expanded its product range into contract life-cycle management and several other categories thereby growing its TAM (total available market). Despite increased usage, DocuSign COGs did not rise (Gross Margin was 79% in Q3). Finally, competition appeared to weaken as its biggest competitor, Adobe, lost considerable ground. This all led to a sizable stock gain of 200% to $222/share at year end.

4. Stitch Fix stock appreciation will continue to outperform the market (it closed 2019 at $25.66/share)

Stitch Fix had a roller coaster year mostly due to the pandemic driving people to work from home, which led to a decline in purchasing of clothes. I’m guessing many of you, like me, wear jeans and a fleece or sweatshirt most days so our need for new clothes is reduced. This caused Stitch Fix to have negative growth earlier in the year and for its stock to drop in price over 50% by early April. But, the other side of the equation is that brick and mortar stores lost meaningful share to eMerchants like Stitch Fix. So, in the October quarter, Stitch Fix returned to growth after 2 weak quarters caused by the pandemic. The growth of revenue at 10% YoY was below their pre-pandemic level but represented a dramatic turn in its fortunes. Additionally, the CEO guided to 20-25% growth going forward. The stock reacted very positively and closed the year at $58.72/share up 129% for the year.

5. Amazon stock strategy will outpace the market (it closed last year at $1848/share)

Amazon had a banner year in 2020 with a jump in growth driven by the pandemic. Net sales grew 37% YoY in Q3 as compared to an approximate 20% level, pre-pandemic. Their gains were in every category and every geography but certainly eCommerce led the way as consumers shifted more of their buying to the web. Of course, such a shift also meant increased growth for AWS as well. Net Income in Q3 was up 197% YoY to over $6.3 billion. Given the increase in its growth rate and strong earnings the stock performed quite well in 2020 and was up 76% to $3257/share.

In our post we also recommended selling puts with a strike price of $1750 as an augmented strategy to boost returns. Had someone done that the return would have increased to 89%. For the purposes of blog performance, I will continue to use the stock price increase for performance. Regardless, this pick was another winner.

6. I added Zoom Media to the list of recommended stocks. It closed 2019 at $72.20

When I put Zoom on my list of recommended stocks, I had no idea we’d be going through a pandemic that would turn it into a household name. Instead, I was confident that the migration from audio calls to video conference calls would continue to accelerate and Zoom has the best product and pricing in the category. For its fiscal 2020-year (ending in January, 2020) Zoom grew revenue 78% with the final sequential quarter of the year growth at 13.0%. Once the pandemic hit, Zoom sales accelerated greatly with the April quarter up 74% sequentially and 169% YoY. The April quarter only had 5 weeks of pandemic benefit. The July quarter had a full 3 months of benefit and increased an astounding 102% sequentially and 355% YoY. Q3, the October quarter continued the upward trend but now had a full quarter of the pandemic as a sequential compare. So, while the YoY growth was 367%, the sequential quarterly growth began to normalize. At over 17% it still exceeded what it was averaging for the quarters preceding the pandemic but was a disappointment to investors and the stock has been trading off since reporting Q3 numbers. Regardless of the pullback, the stock is ahead 369% in 2020, closing the year at $337/share .

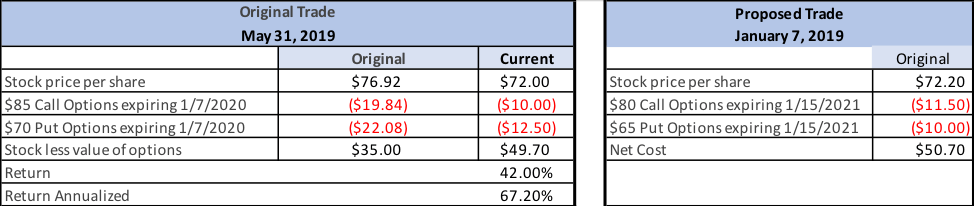

In the post we also outlined a strategy that combined selling both put and call options with purchasing the stock. Later in the year we pointed out that buying back the calls and selling the stock made sense mid-year if one wanted to maximize IRR. If one had followed the strategy (including the buyback we suggested) the return would still have been well over a 100% IRR but clearly lower than the return without the options. As with Amazon, for blog performance, we are only focused on the straight stock strategy. And this recommendation turned out to be stellar.

Unusual Year for the Non-Stock Predictions

7. The major election year will cause a substantial increase in advertising dollars spent

This forecast proved quite valid. Michael Bloomberg alone spent over $1 billion during his primary run. The Center for Responsive Politics reported that they projected just under $11 billion in spending would take place between candidates for president, the Senate and the House in the general election. This was about 50% higher than in 2016. Additionally, there will be incremental dollars devoted to the runoff Senate races in Georgia. This increase helped advertising companies offset some of the lost revenue discussed above.

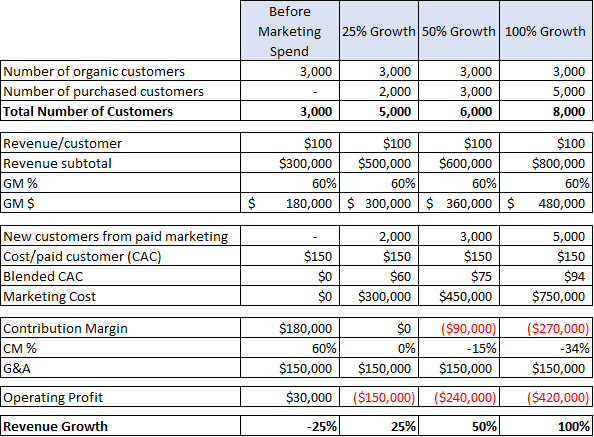

8. Automation of Retail will continue to gain momentum

Given the pandemic, most projects were suspended so this did not take place. And it may be a while before we have enough normalization for this trend to resume, but I am confident it will. However, the pandemic also caused an acceleration in eCommerce for brick and mortar supermarkets and restaurants. I’m guessing almost everyone reading this post has increased their use of one or more of: Instacart, Amazon Fresh, Walmart delivery, Safeway delivery, Uber Eats, GrubHub, Doordash, etc. My wife and I even started ordering specialty foods (like lox) from New York through either Goldbelly or Zabars. Restaurants that would not have dreamed of focusing on takeout through eCommerce are now immersed in it. While this was not the automation that I had contemplated it still represents a radical change.

9. The Warriors will come back strong in the 2020/2021 season

This was my fun prediction. Unfortunately, the combination of injuries and Covid eliminated fun for sports fans. I expected that there would be enough games in 2020 to evaluate whether my forecast was correct or not. Since the season started in late December its premature to evaluate it. Also, I pointed out that the team had to stay relatively healthy for the prediction to work. Guess what? The Warriors have already had 2 devastating injuries (Thompson the critical one, and Chriss, who I expected would help the second team as well).

Yet, several things I predicted in the post have occurred:

- The younger players did develop last season, especially Pascal

- The Warriors did get a very high draft choice and at first blush he seems like a winner

- The Warriors did use the Iguodala cap space to sign a strong veteran, Oubre.

Given the absence of Thompson, the team will be successful if they make the playoffs. So, let’s suspend evaluating the forecast to see if that occurs in a packed Western Conference despite losing Thompson. Last year they started 4 and 16. For the 2020-2021 season (as of January 3) they are 3 and 3 and appear to be a much better team that needs time to jell. But the jury is out as to how good (or bad) they will be.

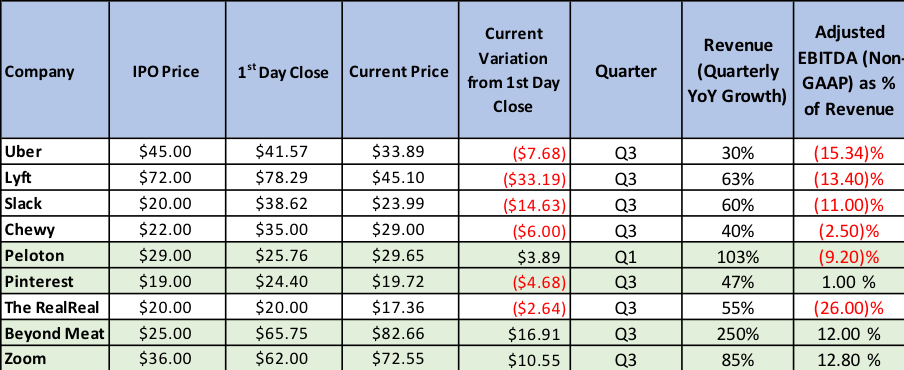

10. At least one of the major Unicorns will be acquired by a larger player

There were 9 Unicorns listed in the post. Eight are still going at it by themselves but the 9th, Slack, has recently been acquired by SalesForce making this an accurate prediction.

2021 Predictions coming soon

Stay tuned for my top ten predictions for 2021… but please note most of the 6 stocks from 2020 will continue on the list and as usual, for these stocks, we will use their 2020 closing prices as the start price for 2021. For any new stock we add, we will use the price of the stock as we are writing the post.

Soundbytes

I thought I would share something I saw elsewhere regarding New Year’s wishes. In the past most people wished for things like success for themselves and/or family members in one form or another. The pandemic has even transformed this. Today, I believe most people are more focused on wishing for health for them, their family, friends, and an end to this terrible pandemic. Please take care of yourselves, stay safe. We are getting closer to the end as vaccines are here and will get rolled out to all of us over the next 4-6 months.